Saylent is a business intelligence and data analytics company that helps small to mid-sized financial companies better reach their banking customers with highly individualized product offerings. Established in 2006 by industry experts with deep experience serving small and medium financial service companies, Saylent provides first-party customer data reporting and debt & credit analytics to regional or community banks and local credit unions that often lack robust analytic capabilities.

Saylent’s Director of Product, Joe Mearn, has overseen the evolution of their platform to better serve their customers, most of which are small financial institutions that don’t have dedicated resources for running marketing campaigns with the insights that Saylent captures. Over the last six years, Joe has had a hand in developing several products, the latest being a marketing platform that creates multi-channel campaigns that target opportunities found in customer portfolios. Laura Costello is Saylent’s Head of Marketing, and since joining last year, has brought a wealth of experience on managing multi-channel campaigns that incorporate direct mail. Together, Joe and Laura help Saylent’s customers simplify the process of carrying out highly effective marketing campaigns.

In the financial sector, direct mail is used heavily to maintain regulatory compliance around customer communications, as email is not always as reliable for them to reach their customers. However, most of this mail is not personalized, or well-timed to align with unique customer activities or milestones. In fact, many institutions are time-strapped and spread too thin to handle the complexity of personalized customer communications, and have a difficult time using their data to segment and target customers based on behaviors. Saylent’s customers also wanted the ability to measure campaign performance, which is more challenging with traditional direct mail campaigns.

Finally, a unique consideration in the financial industry: marketing campaigns must be rigorously vetted by their internal compliance departments, especially since marketing materials must include required regulatory language. Any last minute edits to the text (and hence, proofs) were subject to approval by compliance, which typically added days or weeks to campaigns in the existing process, making long lead times even longer than the norm.

Thus it was important for Saylent to create an all-inclusive, intuitive campaign platform with a smart recommendation engine powered with the institution’s own customer data, but differentiated by incorporating direct mail as a viable channel that can offer dynamically personalized content in a simple, fast, and straightforward way.

Prior to implementing Lob into their newly designed platform, Saylent’s customer experience team was manually executing 250-300 direct mail marketing campaigns for their customers annually. This legacy process took about six weeks of effort each quarter, involving three individuals to run campaigns, and was dominated by time-consuming and manual processes such as consolidating customer lists and data from disparate systems, creating art files, proofing and validating with commercial printers and with compliance teams at each of their customers. Additionally, these campaigns were turnkey templates, which worked well for customers but did not allow for any dynamic customizations or more targeted campaigns to take place.

Joe and his team looked to create a new platform that prescribes revenue or customer engagement opportunities by surfacing key insights from customers’ own banking portfolios. The new platform needed to automate direct mail alongside email and other communication channels. Here, Lob was expected to play an integral part of the API suite for delivery channel integrations. Lob’s API offered an efficient and elegant solution for Saylent’s customers to send personalized and relevant direct mail to their customer base, and gain major time and resource savings without the back and forth that was previously required. What’s more, Lob could unlock the capability to send small batches with dynamic content in a way that previously didn’t make sense with traditional print shops. “The API capabilities was one of the reasons why we chose Lob," Joe remembers, “because we wanted more efficiency without having to spend a lot of time passing files back and forth.”

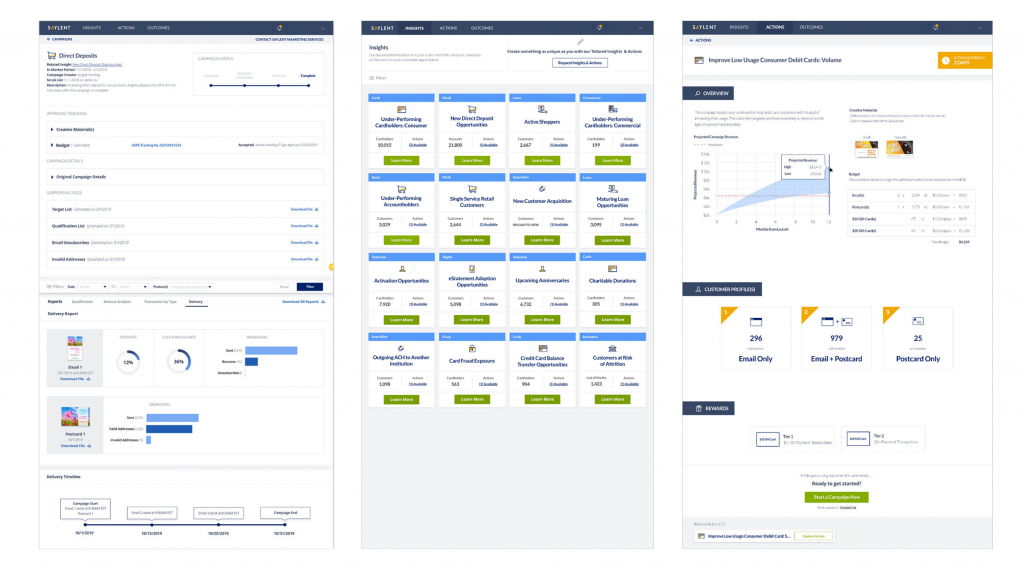

Saylent’s newly created platform, Engage, was designed to drastically simplify the process of getting targeted campaigns to market. It helped to identify opportunities and prescribe campaigns that are most likely to drive customer action. It included many recommendations: segments to target, optimal delivery channel combinations, and online and offline delivery channels to reach select audiences.

Following a quick two-week integration, Lob’s functionality resolved all issues traditionally surrounding print and mail by eliminating the majority of their necessary manual work overnight. Saylent was able to aggregate and execute direct mail campaigns for all customers, automatically. Better yet, Saylent’s clients could run customized campaigns that provided relevant messaging to their customers, increasing engagement and building stronger customer relationships. Plus, Saylent could now create, adjust, and proof each piece of direct mail instantly. Lob provided the necessary flexibility to build and edit campaign templates with ease. This meant any last minute edits to the disclosure content could be instantly reviewed and didn’t impede delivery times.

“Lob created a more efficient process with more flexibility and saves everyone time and resources,” Laura says. “All of our campaigns are targeted, and sometimes these groups are fairly small, and it’s not as cost efficient to mail with a traditional printer. Lob gives us a capability to do it in a way that makes sense and we’re not spending 5x what we should be because we’re paying a minimum fee to set up with a print shop.”

Additionally, Lob’s address verification capabilities offer data cleansing to maximize mail deliverability. For every direct mail campaign that is run, Saylent automatically provides reports of bad addresses back to their customers. By doing so, Saylent’s customers not only save money on undeliverable mail, but they also prevent bad address data from inflating customer verification costs. Joe says, “We definitely get more addresses removed; addresses coming back as invalid with Lob than ever before.”

Finally, Lob’s ability to track any individual mailpiece during its production and delivery provides unprecedented visibility to Saylent’s customers by keeping them informed of which campaigns are performing well. By incorporating this highly personalizable and timely offline engagement channel, Saylent’s customers were now able to send highly targeted, small volume mailings as part of their prescribed marketing campaigns to any customer or prospect to influence their behavior, just as easily as they would for digital channels.

See Saylent's direct mail campaign in our Best Direct Mail Campaign gallery and see how you can put intelligent direct mail to work!

Contact us for a personalized demo.